Photo Credit Aspen Snowmass Sotheby’s

Buying your first home or second home is always stressful. Unlike buying your first home there are additional factors that come into play from financing the home to maintaining it. Vacation home buying 101 talks about some of the issues that could come up for a buyer who plans ahead will navigate through the choppy waters with ease.

Affordability and Risk

1) Can you afford to buy the vacation home on your own? Buyers often pool their money with friends and family to be able to afford the vacation home of their dreams. Buying a home with anyone who you are not married to can present some long-term problems

Just because you like the beach home, but by the same token someone might feel they like the ski house more. In addition, just because you think you can afford that vacation home don’t assume someone else will agree. Last, what if that person credit isn’t as great as yours, and they stumble later on making those mortgage payment or the down payment.

Once you have closed on your new second home who pays for what? Buying with friends and family can be tricky. Regardless who you buy with but especially if they are not married have an attorney spell out maintenance and mortgage payment so you both have this be an official agreement where you both are held accountable.

Photo Credit for MAUI BEACH PLACE, ORCHID, KIHEI, HAWAII Island Sotheby’s International

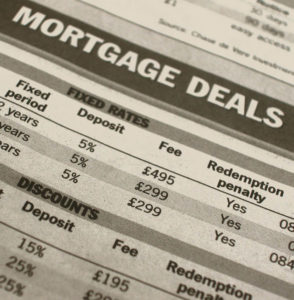

Financing

Financing the home

2) Even if you can buy a vacation home on your own, it will be complicated. You most likely won’t be able to use an FHA loan you will most likely need conventional financing. Conventional financing could mean your credit will need to be in tip-top shape. Your debt to income will need to look good. Some financial experts suggest someone buying a second home have 12 months of income in reserves

Maintenance Plan

3) Do you have a plan for offseason maintenance

Just like your primary home, the second home will require maintenance. Do you have someone who can swing by the house or condo if a pipe bursts, what if there is a break in? Hiring a security person to check on your home is not a bad idea. They can check to make sure the house is warm enough, Check on the well being of the home making sure your home doesn’t look vacant.

Getting the most value

4) Renting your vacation out when you’re not using it.

Talk to your accountant making sure you’re not educating something from your taxes that you shouldn’t be or taking those deductions. A solid accountant will make sure you’re doing everything right on your taxes. Making sure where your second home allows you to rent the home out and for how long. If your home is part of an association they might say yes you can rent your home out but comes with some additional limitations. For instance, you might not be able to rent it out via Airbnb by the day or week, but you can rent it out for a certain amount of weeks.

Property Management

Making sure you have maintenance in order from mowing the lawn, to repair guy to fix what renters break and who is going to clean the home after the renter leaves getting the home ready for the next crew? Who’s going to draw up the lease and collect the funds and give out keys? Do you need to think about all these matters along with legal matters like do I make renter get renters insurance? Do I allow dogs and what kind of deposit can I collect? Will you get enough rent to collect to cover your expenses for the home? Knowing your home is indeed very important in addition consulting your Local Real Estate agent would be a great idea.

Moving on from your Investment

5) One day you will want to sell

One day you will want to sell the vacation home and that can be costly to do. Not every market is the hot market. In reality, you could be holding onto that property longer then you wanted which could be costly. At the same time, it can also be costly due to capital gains tax as well. Before you go on the market and list that property talks to a few agents and people in the neighborhood to see what sales history looks like.

I always say to my buyers assemble your team in the first place. In reality, it will make your life a lot easier when the team is in place. Make sure your accountant has run the numbers realistically, advise you on the costs assoc with buying a second home. Talk to your attorney and if your attorney is not familiar with the state or country your buying in talk to someone who is. Other folks you should talk to are your mortgage broker and financial planner. Get the team together ahead of time will help dodge some of the headaches.

If you are looking to buy your first home or second or third having the right team in place can make your life easier and an experienced agent who can predict those headaches can help. If you want more information about buying or want to start the process contact me and lets start that local, national or global search today.

Leave a Reply