You have sat on the sidelines and rented a place or stayed in your current place that you own and now your thinking 2014 is your year to enter the buying market or your thinking this is the year you sell and upgrade your living situation. Whatever your motivation is there a few things you need to think about when you’re entering the buying market. Gone are the days where sellers took you’re less than asking offer. I am sure we all have seen the articles reporting seller got over asking. Buyers don’t get discouraged. Economists have been saying interest rates are going to rise in the in the year, and you might be going oh great maybe we should rent. Since interest rates are going up yes you will get less house for your dollar, but it might help you since developers and investors are starting to leave the market, and they are typically the buyer who is buying a place with cash and if your buyer who doesn’t have that luxury to buy a home with cash you might be competing with folks who are more just like you making the playing field a little bit more equal. The investor and developer have been a big piece of the pie causing the rise in home prices. They are not the whole piece of the pie you might still have that cash buyer you’re competing with, but you might find a few less. Before you decide to buy you should do the following things.

You have sat on the sidelines and rented a place or stayed in your current place that you own and now your thinking 2014 is your year to enter the buying market or your thinking this is the year you sell and upgrade your living situation. Whatever your motivation is there a few things you need to think about when you’re entering the buying market. Gone are the days where sellers took you’re less than asking offer. I am sure we all have seen the articles reporting seller got over asking. Buyers don’t get discouraged. Economists have been saying interest rates are going to rise in the in the year, and you might be going oh great maybe we should rent. Since interest rates are going up yes you will get less house for your dollar, but it might help you since developers and investors are starting to leave the market, and they are typically the buyer who is buying a place with cash and if your buyer who doesn’t have that luxury to buy a home with cash you might be competing with folks who are more just like you making the playing field a little bit more equal. The investor and developer have been a big piece of the pie causing the rise in home prices. They are not the whole piece of the pie you might still have that cash buyer you’re competing with, but you might find a few less. Before you decide to buy you should do the following things.

1) Get your finances in order. Make sure all your bills like credit cards, car payments are paid on time and that you don’t have too much debt.

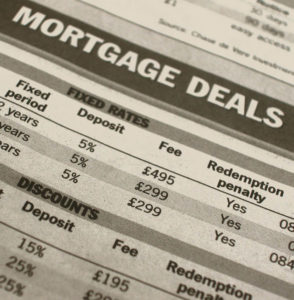

2) Talk to a mortgage broker find out what the max you can borrow safely when buying a home and realize putting a good down payment will help you. Know how much you have saved to put down for a down payment. There are programs out there where you don’t have to put much down, but the more you can put down the better you will be. Really explore all your options with your mortgage banker.

3) When you meet with your mortgage banker ask them the question you need to be asking or your broker needs to be asking when looking at property. For example, some banks require if you’re looking for a condo that the condo has at least fifty percent owner-occupied or higher to secure a mortgage. One question you should ask your Mortgage banker is how much time does the lender need to secure my mortgage realistically to close on time. I had a buyer who bought a condo in the North End and they asked the Bank if we want to push the closing up is that possible and how much time do you need? The banks response was just to pick a date, and they threw out a date and said would this date work or are we cutting things too tight, and the bank failed to give the buyer and the buyer agent guidance in this department and in the end the buyer was put through a lot of stress they didn’t need to experience. Your mortgage broker should be able to provide lots of guidance in the beginning and as the transaction moves forward they should be able to provide more detail guidance. Giving what if situations, when you’re picking a lender, are a good thing to do it’s not just about rates. It’s also about your lender keeping the deal together if you’re doing your part in the transaction.

4) Get that pre-approval letter give a copy to your real estate agent at the first meeting. Meet with your agent and talk about the must-haves. Talk about all the neighborhoods of interest to you and why they appeal to you.

5) Get your team in order. You should really have the following folks lined up before you start looking in this market. Your team should consist of Attorney and ideally an attorney who does a lot of real estate transactions. When you meet with your attorney go over if they charge a flat fee or hourly rate. If you can get the attorney who charges a flat fee that is better, but if you’re paying by the hour know that your real estate agent should be able to talk to your attorney micro-managing your agent will cost you time and might frustrate you in the end. Once your attorney is lined up you should have a home inspector in mind. The worst is when you have to find just any home inspector last minute. Try to line up a name and company before you look at places. If you don’t know of one your real estate agent should be able to help you find both an attorney and home inspector. Home decorator if you plan to hire someone to install window treatments or help you decorate let them know you’re going to be entering the buying market. They also might be able to help you with a place that has odd angles so you might want to bring them when you set up a second showing or if there is a property you really like. They might be able to help you figure out how to furniture making that property you were going I don’t know into a total yes.

5) Get your team in order. You should really have the following folks lined up before you start looking in this market. Your team should consist of Attorney and ideally an attorney who does a lot of real estate transactions. When you meet with your attorney go over if they charge a flat fee or hourly rate. If you can get the attorney who charges a flat fee that is better, but if you’re paying by the hour know that your real estate agent should be able to talk to your attorney micro-managing your agent will cost you time and might frustrate you in the end. Once your attorney is lined up you should have a home inspector in mind. The worst is when you have to find just any home inspector last minute. Try to line up a name and company before you look at places. If you don’t know of one your real estate agent should be able to help you find both an attorney and home inspector. Home decorator if you plan to hire someone to install window treatments or help you decorate let them know you’re going to be entering the buying market. They also might be able to help you with a place that has odd angles so you might want to bring them when you set up a second showing or if there is a property you really like. They might be able to help you figure out how to furniture making that property you were going I don’t know into a total yes.

5) Make sure you’re going to be able to commit to a home for 5 years or longer. If you’re not sure you can you live there for 5 years or longer but know you can commit for less than at that time you should explore the idea of renting it out. Find out how much you could get the property you for rent. If you can rent it to cover the mortgage, but not living there physically it might be a good investment. So take the time to educate yourself on the rental market or hire an agent who does both rentals and sales. Keep in mind rents will go up and down so whatever figure an agent gives realize it isn’t set in stone.

6) Plan what open houses you want to attend. Most open houses are published on Thursday so if you take Friday and Saturday to plan open house tours for Sunday. Try to organize the open houses by the level of interest and neighborhood. If there is a property you really want to view and are excited tell your real estate agent and ask them to come to the open house and ask them to bring paperwork. Many open houses are Sunday but at times you will find there is an open house during the week or on a Saturday try to attend if you can it might help you. Sometimes sellers will do an open house during the week and have one scheduled for Saturday or Sunday. Ask your agent to tell you if the property has an open house during the week. If they do try to attend. Attending during the week might give you an edge allowing you to put an offer in before the weekend which is when more folks looking at the property. If the Seller agent says owner won’t look at offers till Sunday open house that is fine you should go to both open houses making sure it’s the place you love, but do make sure your agent is at the Sunday open house so the offer can be written right after. If at all possible before you attend the open house speak to your agent and ask them to reach out to the listing broker and find information that isn’t stated in the listing sheet you’re seeing online so you have the basic facts covered. For example owner-occupied ratio, any pending assessments are some that are sometimes not mentioned on open house info or listing sheet you see online.

6) Plan what open houses you want to attend. Most open houses are published on Thursday so if you take Friday and Saturday to plan open house tours for Sunday. Try to organize the open houses by the level of interest and neighborhood. If there is a property you really want to view and are excited tell your real estate agent and ask them to come to the open house and ask them to bring paperwork. Many open houses are Sunday but at times you will find there is an open house during the week or on a Saturday try to attend if you can it might help you. Sometimes sellers will do an open house during the week and have one scheduled for Saturday or Sunday. Ask your agent to tell you if the property has an open house during the week. If they do try to attend. Attending during the week might give you an edge allowing you to put an offer in before the weekend which is when more folks looking at the property. If the Seller agent says owner won’t look at offers till Sunday open house that is fine you should go to both open houses making sure it’s the place you love, but do make sure your agent is at the Sunday open house so the offer can be written right after. If at all possible before you attend the open house speak to your agent and ask them to reach out to the listing broker and find information that isn’t stated in the listing sheet you’re seeing online so you have the basic facts covered. For example owner-occupied ratio, any pending assessments are some that are sometimes not mentioned on open house info or listing sheet you see online.

7) When you put in your offer in realize you might not be able to put subject to inspection. I always want my buyers to put an offer subject to inspection, but keep in mind you might be going up against buyers who aren’t asking to do an inspection and can make an offer or break an offer. Some sellers will take the offer with no inspection so you need to mentally prepare yourself and ask yourself is an inspection a must with you, and if yes just understand you might lose an offer or two but the right home will come and have that inspection request will be a good thing. Some buyers still do an inspection but just don’t make it part of their offer. If there is something major that comes up talk to your attorney and your attorney, agent and you will find the best plan attack even if you didn’t put your offer in subject to inspection. If you have a friend in construction or a home inspector, not a bad idea to bring them with you when looking at places, but keep in mind they are only going to be able to see common areas and the condo its self. They will not be able to see the roof and systems. When you buy a condo or single family without inspection it’s buying it as-is you take it with any issues the home might have. You need to be comfortable with that if you forgo the inspection. I often talk to buyers and ask them to start thinking about this aspect early on. Don’t wait till you put an offer to weigh the pro and cons inspection or no inspection. If you think about this aspect of every property you visit might help you make a decision when you find a property you really love.

7) When you put in your offer in realize you might not be able to put subject to inspection. I always want my buyers to put an offer subject to inspection, but keep in mind you might be going up against buyers who aren’t asking to do an inspection and can make an offer or break an offer. Some sellers will take the offer with no inspection so you need to mentally prepare yourself and ask yourself is an inspection a must with you, and if yes just understand you might lose an offer or two but the right home will come and have that inspection request will be a good thing. Some buyers still do an inspection but just don’t make it part of their offer. If there is something major that comes up talk to your attorney and your attorney, agent and you will find the best plan attack even if you didn’t put your offer in subject to inspection. If you have a friend in construction or a home inspector, not a bad idea to bring them with you when looking at places, but keep in mind they are only going to be able to see common areas and the condo its self. They will not be able to see the roof and systems. When you buy a condo or single family without inspection it’s buying it as-is you take it with any issues the home might have. You need to be comfortable with that if you forgo the inspection. I often talk to buyers and ask them to start thinking about this aspect early on. Don’t wait till you put an offer to weigh the pro and cons inspection or no inspection. If you think about this aspect of every property you visit might help you make a decision when you find a property you really love.

8) Do your homework and ask your agent to help you do your homework on property that interests you. Find out if there were any other units in the building that sold fairly recent. If yes what were they and what did they sell for? What else in the neighborhood has sold and has it sold for asking or over? A lot of information you can find out through public record and a lot of it is online. Knowing this will help you plan of attack before you attend an open house. Talk to your mortgage broker ask them if there are any details that are important to know and see if they can issue you a new approval letter if it’s over 30 days.

9) If you see a property on the market for a while you might want to ask the question why this hasn’t sold. Keep in mind there might not be anything wrong with the property it might be just looking for the right owner it speaks to, and you might be it. Ask your agent to do some research though before putting an offer in. You might be able to offer less than asking in this situation. Also if a property has been on market for a while you might be able to put offer subject inspection especially if you’re the only offer on the table.

10) Prepare yourself mentally when you start this process and when you’re in the thick of it. Buying a home is stressful and will have ups and downs. When you put in offer prepare yourself if you get the place how will you feel and how will you feel if you are rejected. Some buyers get rejected several times before they hear those magic words your offer has been accepted. Your home is out there and it might take a few tries, but remember it will come you have to stay calm and remind yourself things happen for a reason.

Much of buying a home is preparing you mentally, and educating yourself on the market is a great way to prepare yourself. Read blogs, articles, visit my site and talk to your agent and lender months before you enter the market will prepare

Leave a Reply